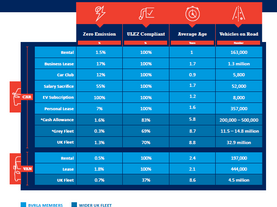

As with other motoring taxes, vehicle excise duty (VED) can be used to encourage the greater uptake of low emission vehicles by making such options more cost effective for motorists. VED on cars has traditionally been calculated on a CO₂ based model, and the Government is considering a similar measure for vans.

Car VED

- HM Treasury continues to look at car VED. The BVRLA responded to last year’s VED call for evidence. We continue to engage with HMT and we expect a consultation on the final structure of VED later this year.

Van VED

- In April 2021 vans were expected to move to a CO2 linked VED structure. This has been delayed, with no new revised date published. The BVRLA continues to engage with HMT on van VED to ensure members have sufficient time for any changes.

Related News