The BVRLA leasing fleet has reached a six-year high, recording 2.2% year-on-year growth to approach levels last seen in Q4 2017. The association’s latest Leasing Outlook Report shows the total lease fleet nudging above 1.9m vehicles thanks to increased demand for leased vans and Business Contract Hire (BCH) cars.

Vans grew 3.3% yoy, hitting 516,253 units. They are now responsible for over a quarter of the total lease fleet. Car fleet growth was lower at 1.8%, with the healthy performance of BCH offset by a small decline in Personal Contract Hire.

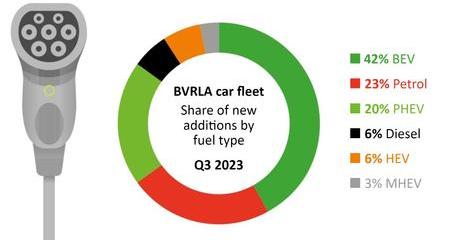

Driven by BCH and salary sacrifice (up 68% yoy), electric vehicles accounted for 42% of new additions to the leasing fleet in Q3 2023. The high demand for BEVs continues the sector’s march to a zero-emission future. BEV uptake for leasing continues to outperform the overall market, with SMMT figures for the same period showing a BEV share of 17%.

The overall fleet growth and continued transition to BEVs have been facilitated by the return of vehicle supply and easing of delivery lead times. Those improvements have been replaced by a perfect storm of parts delays and a technician shortage, combining to increase downtime for service, maintenance, and repair (SMR) work.

Nearly 900,000 vehicles (64%) on the leasing fleet are now provided with service packages from the leasing provider. That proportion is growing as leasecos seek to manage longer lead times for parts and an increase in workshop visits due to fewer ‘right-first-time' repairs. 77% of BCH agreements for cars in Q3 2023 included maintenance, while LCV agreements including fleet management are up 25% year on year.

Toby Poston, BVRLA Director of Corporate Affairs, said: “Stability and certainty breed growth, and the leasing sector is reaping these benefits when it comes to vehicle supply and Benefit in Kind Tax.

“As ever, a more detailed analysis shows that some motor finance products are doing better than others, while new supply chain challenges continue to appear. The BVRLA will continue to work with policymakers and colleagues from across the automotive industry to try and deliver positive market momentum across all segments.”

The full report includes analysis from Auto Trader, Cap HPI, and Fleet Assist. It can be read on the Leasing Outlook page.

Note: SMMT data taken from registration data published for July, August and September 2023.