Here you will find the latest news, updates and communication resources from the BVRLA. Members, media partners, journalists and other commentators can feel free to republish the content in part or in full, crediting the association.

Latest News Stories

Read more News Stories...Latest Press Releases

Read more Press Releases...Communications Toolkit

For more toolkits click here....Exclusively for members, the BVRLA Communication Toolkits each contain a suite of free-to-access digital, social and print resources to support members' own communications relating to a specific topic. Login to the BVRLA website to access the resources. Co-branded versions can be requested from the communications team.

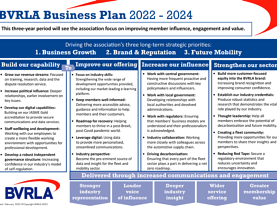

Corporate Publications

The BVRLA produces three annual corporate publications and a quarterly newsletter. The Annual Review provides and overview of the association's deliverables at the year end, the Annual Report contains the association's statutory financial statement and the BVRLA Business Plan sets out the association's strategic priorities.

Media Contacts

Using BVRLA Images

Images of Chief Executive Toby Poston can be accessed via the BVRLA Flickr Channel which hosts a range of photo albums containing the latest images from BVRLA events.

Journalists, members, partners and other commentators are invited to use the images to accompany stories relating to the BVRLA.

Using the BVRLA Logo

Members are encouraged to proudly display the BVRLA logo on promotional material and websites making clear that they are a BVRLA member.

Members can request the appropriate BVRLA logo from the communications team.